What is Synthetic Identity Fraud? When a criminal CREATES an identity instead of stealing one.

Types of Synthetic Fraud

- Identity Fabrication: Identity is completely false

- Identity Manipulation: Identity data elements tweaked to create a new identity

- Identity Compilation: Pieces of different identities are compiled to for a new identity

One of largest known synthetic identity fraud rings fabricated over 7,000 false identities to obtain more than 25,000 credit cards.

The scam resulted in more than $200 million in confirmed losses to business and financial institutions.

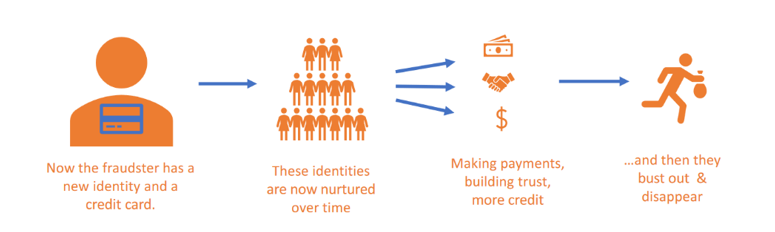

Now that the Identity has been built, Then What Happens?

Why is it Challenging to Detect?

6-7 million identities establish a credit file each year in the US

- Young people come of age

- Immigrants establish credit

Most synthetics look like creditworthy applicants

- Majority seen with good to excellent credit scores when a credit history is found

There is no consumer victim

- There is no consumer that suffers and reacts to loss or identity theft

- The fraudster is the only individual with contact points and answers to questions

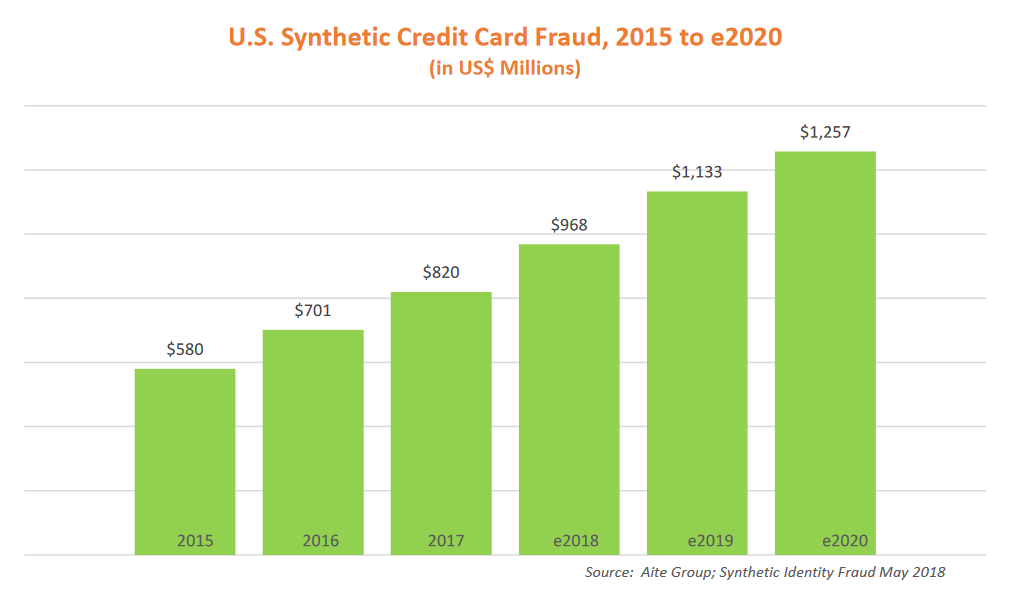

Synthetic Fraud Losses

- Responsible for 20% of credit losses with an avg charge-off of $15,000.

- The problem might be even larger as it can often be reported as bad debt.

By 2021, first-party fraud and synthetic identity fraud will account for 40% of credit write-offs, up from an estimated 25%. – Gartner

It’s not surprising that fraudsters have found new and innovative ways to game the system. In the long-term, improved customer service will be essential in the fight against increasingly-sophisticated fraud schemes. If we can reliably link accounts with genuine, legitimate account-holders, it becomes much, much harder for fraudsters to operate.

Of course, synthetic identity fraud is happening right now, so it’s also important to understand how synthetic identities can be distinguished from genuine applicants. At face value, it can be extremely difficult to distinguish between the two, but there are some questions we can ask as a starting point:

- Does the applicant have a thin credit file or limited information available via the credit bureau?

- Is there any substantive proof of the applicant’s existence? For example, do they have a driver’s license, social media presence, loans, or insurance products?

- Are there any credit losses tied to the applicant’s address?

- Is the same mobile device tied to multiple accounts?

- Do credit loss transactions link back to the same merchants?

Fraudsters do their best to make their synthetic identities appear as authentic as possible, but there is only so much they can do.